Fintech has been dominating headlines in 2016, and for good reason. Ever since the financial crisis of 2008, Wall Street and everyday investors alike have been scrambling for safer ways to invest and manage their money. The fear of another Lehman moment has driven financial services firms to re-evaluate their tools of the trade.

As a result, the following years came with unprecedented growth in technologies such as robo-advisers, mobile payments, data analytics and crowdfunding. In fact, Fintech funding hit an all-time high in 2015, exceeding $19.1 billion.

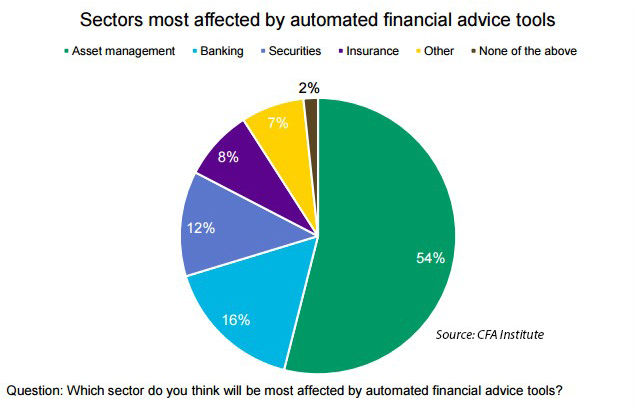

Unsurprisingly, RIAs and other asset managers are thought to be most affected by this adoption of digital financial advice tools.

Even though it’s no secret that these developments are revolutionizing the RIA landscape, many in the field are still unsure about their potential impact, good or bad, on the industry at large.

On one hand, in addition to cutting costs and adding simplicity, advancements in technology democratize access to financial tools and platforms previously reserved for only high-level institutions. That means there are fewer growth barriers preventing smaller firms or startups from playing in the big leagues.

On the other hand, a leveled playing field when it comes to tools, resources and capabilities makes it harder for RIAs to differentiate their services and shine a spotlight on what makes their brand unique.

So when all your competitors are at the same starting line, how do you get a head start in the race to stand out?

1) Sell a story, not a product.

This may go back to marketing 101, but it’s important for RIAs to remember that clients aren’t just investing in products, they’re investing in the story they tell. Selling your story is an opportunity to distinguish what sets you apart from your competition, even if the technology you’re using appears to be similar. The first step to telling an effective story is developing consistent messaging. Are you disruptors of the industry empowering risk-tolerant investors, or are you traditionalists seeking to reestablish investor faith in tried-and-true strategies? No matter what your objective is, your messaging should leverage your unique story, highlight your employees’ exceptional skills and inspire confidence among current and prospective clients in your ability to offer cheaper, simpler or higher-quality services than an automated platform.

2) Add value with thought leadership.

Once you have a strong message as your foundation, elevate your brand credibility online to position your firm as an industry powerhouse. Content is key to building this digital footprint. When potential investors research your firm online, they should instantly find a variety of resources that paint a clear picture of the value-added services you offer over the competition. Whitepapers, blog posts and bylined articles serve as effective vehicles to publish expert commentary. This forges a sense of authority and trust unattainable by automated systems unwilling to spend the time and resources to generate original content or research.

3) Develop a strong presence in appropriate markets.

Even the most compelling stories won’t make an impact if they aren’t reaching the intended audience and distributed through the right channels. The media is one of the most pervasive tools at your disposal for disseminating thought leadership in today’s digital landscape. Technology has made it easier than ever to communicate with mass audiences. That means every day, people are bombarded with ads for the latest Fintech products and trends. To avoid getting lost in the ocean of online content, it is essential to direct your communications to the right audience. A proven method for this is targeted media outreach, utilizing both print and broadcast outlets that your target customers consume regularly. This delivers your message directly to people who are most open to receiving it.

At the end of the day, technology will never fully replace the need for a human financial adviser. As United Capital CEO Joe Duran has said, “discipline is the difference between man and machine.” However, it enhances the need to effectively market and communicate the story behind those services. Even if your bread-and-butter product offerings have not changed, the recipe to success has, and it’s imperative that these three communications strategies be part of the mix.