Despite standing at over $3 trillion in global assets today, investors and advisers still want to know ─ how high can ETFs fly? The industry has come a long way since the first U.S.-listed ETF began trading in 1993, but a flurry of unanswered questions continue to swirl regarding the proliferation of thematic products and how to compete with the “big boys” when it comes to distribution.

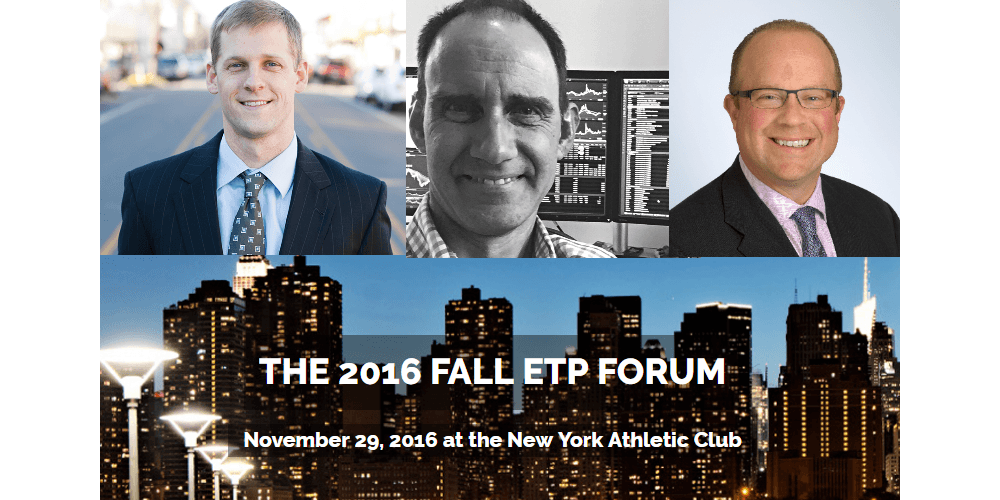

At Gregory FCA, we’re all about contemplating these important questions and engaging the top thinkers across the investment landscape. Ahead of this year’s Fall ETP Forum in New York City, we’re offering a sneak peek into the minds of three speakers on the conference’s highly anticipated New-to-Market ETF Roundtable. We asked the below panelists about the trends shaping the ETF industry as we head into 2017, and how their firms intend to take advantage:

- Jamie Anderson, Managing Principal, Tierra Funds — We are an Americas-focused ETF sponsor. We are actively involved in the Latin America space as an adviser for real estate investing and we manage a proprietary actively-managed fund, the Tierra XP Latin America Real Estate ETF (LARE). We are one of the top performing listed real estate funds in the world.

- Dodd Kittsley, Director, Davis Advisors — We’re planning to offer transparent actively-managed ETFs in early 2017 to give investors greater access and freedom of choice. As an asset manager with almost 50 years of investment experience and $25 billion in AUM, we offer our investment discipline and research expertise to investors in the vehicle of their choice. Our three ETFs will be among the first actively-managed equity ETFs based upon fundamental bottom up stock selection. Our ETFs will offer exposure to U.S. equities, the financial sector and global equities.

- JD Gardner, Founder, Aptus Capital Advisors – Our firm’s area of expertise lies in behavioral finance and the momentum anomaly. We try to provide advisers and their clients with efficient market exposure. We are an index provider to the Aptus Behavior Momentum Index and we are the issuer of the Aptus Behavior Momentum ETF (BEMO) which is designed to track our index.

As part of the “New to Market” panel, what big trends in new products are you watching/seeing as we head into 2017?

Jamie:

Broadly speaking, the most interesting trend we have been following is the accelerating growth of new products introduced to the market. The majority of this growth has been in a vacuum, so heading into 2017 we are looking to see what the response will be from the hedge fund and active mutual fund industry which control a combined $4 trillion AUM. While a great deal of AUM is flowing into index products and out of active strategies, the amount of AUM on non-ETF platforms is still six to seven times that in ETFs. The response we see from these other segments, specifically as it relates to the large discount ETF issuers, stands to be more disruptive. It will likely impact the pace in which we see thematic and smart beta ETFs emerge.

Dodd:

In 2017, we expect to see continued strong overall demand for ETFs as an increasing number of investors recognize the material benefits that the ETF structure can offer. Year to date, ETFs in the U.S. have taken in more than $215 billion in net new assets and are on pace for another record year of inflows. ETFs have truly democratized investing by making more exposures relevant and accessible to a broader investor base. The use of ETFs to access index based strategies will likely continue to grow. However, investors are beginning to recognize that the benefits of the ETF structure are not limited to just index based investments but also apply to strategies – both rules based and active. We expect that such strategies are poised for growth when delivered in an ETF.

JD:

I think the biggest overall trend is a result of some shifting that is happening within the industry as a whole. ETFs are popping up on more and more radars, and that’s a good thing. The structural efficiency of an ETF is pretty compelling when you get into the nuts and bolts. There are still a lot of advisers that don’t use or understand ETFs, and they might not use them because they don’t understand them fully. I think some of the push toward more of a fiduciary standard is going to build awareness of the underlying mechanics of an ETF, and that’s good for the overall industry. So, I think the biggest trend is the growing number of advisers that want to learn and understand how to best use ETFs.

As we gear up for the next generation of ETFs to enter the industry, what do you expect to see more or less of? Thematic ETFs, smart beta, low volatility?

Jamie:

We believe every product, especially those in the ETF wrapper, should provide distinct access to markets and/or securities that are unavailable in other products. Providing access to a basket of equities that is not otherwise available in the ETF format brings an immediate value add to the table for investors. The issue that arises with thematic and smart-beta ETFs is you are often getting branding and packaging as opposed to truly unique access.

I think we are at the top of the market for relatively expensive thematic products. While many are interesting and unique, once you lift up the hood and evaluate the components of these products you find they are accessible through multiple alternative products, which to us suggests the fees need to come down. This is what is at the heart of the matter – you can’t charge a lot for something that doesn’t provide unique access. By not reducing fees, these products will become vulnerable to discount issuers who can easily come in and do it for less. Once that happens, we will start to see a commoditization of the thematic space as we’ve seen with sector-focused strategies.

In terms of smart beta and quantitative approaches, the jury is still out. A lot of these strategies are unique and interesting, but on the flip side, the challenge with these strategies is they tend to be complicated and hard to explain to the average investor. Ultimately, from a quantitative finance perspective, low volatility and beta tend to be diametrically opposed. It’s like saying you can enjoy the sunshine and the moon at the same time – it’s a really uncommon event. The key challenge is keeping the strategies easy for investors to understand while also avoiding the direct threat they face from the hedge fund space—which we think could really compete with smart beta. Frankly, any hedge fund not looking at launching a parallel ETF strategy is missing a huge opportunity.

Dodd:

The actively-managed ETF market continues to grow. There are roughly 160 actively-managed ETFs among 30 providers and over $28 billion in assets. While active ETFs only account for 1 percent of total ETF assets in the U.S., material growth has occurred and is expected to continue. Fixed income remains the dominant active ETF category, accounting for over 75 percent of active ETF assets. However, we expect actively-managed equity ETFs to grow meaningfully in 2017 as additional compelling strategies emerge.

JD:

In terms of the pure broad market exposure passive ETF, there isn’t much room left for improvement. The big boys have done a really good job there. But, there’s always going to be space for managers that are willing to have a significant amount of active share and conviction in their process and whatever their edge may be to differentiate from a broad based benchmark like the S&P 500. Turning those processes into a rules based system with an underlying index can be a really attractive package.

I think you are going to see more people trying to figure out how to turn an active approach into a systematic process without limiting what the edge really is.

What big trends do you see and how does your firm intend to take advantage?

Jamie:

There is a David and Goliath theme in the ETF industry, and it all comes down to distribution. One of the advantages of the ETF wrapper is visibility and that it trades like a stock. In theory, if you are reaching your audience and they like the concept, it’s relatively easy for them to buy it. Distribution is the biggest challenge for small startup firms, because without the ability to market the product, you will likely lose money for a number of years. I see hints of changes in the industry, particularly in terms of the sophistication of independent asset managers who are using ETFs exclusively and who pay attention to what the ETF is doing. They’re looking at its relative cost and its performance – not just the brand or the headline strategy. We feel good about this because the unique access LARE provides makes it virtually impossible for the average investor to take advantage of the growing real estate and emerging market sectors without looking at LARE. Even an ETF replication strategy will not work as our access is so unique and certain markets like Brazil are inaccessible. Additionally, because we are focused on the Americas, we are not just looking at U.S. retail or institutional investors, but the local institutional investors in Latin America. As real economies go, we believe that is where financial products should try to focus.

Dodd:

Despite the massive growth in the ETF industry over the past ten years, the market remains relatively concentrated with the top three issuers accounting for over 80 percent of all industry assets. However, we expect that the ETF industry will become more diversified in the coming years both in terms of products and managers. Innovation is alive and well. Year to date, over 200 new ETFs have been issued. In addition, ETFs launched in the past 12 months have gathered more than $6 billion in net new assets. There is meaningful opportunity for growth by offering additional strategies and market segment exposures in an ETF format.

Be sure to follow Gregory FCA’s conference representatives Amy, Jess, Rachelle and Rans on Twitter (@alash929, @jesskemery, @Rachelle_Gaynor, and @ransfordw215) for live updates. We’ll be live tweeting from the conference sessions with the hashtag: #ExpertSeries2016.

This post is a collaboration between Joe and two other members of the Gregory FCA team, Jess Emery and Amy Lash.